33+ fed rate hike and mortgage rates

Take Advantage And Lock In A Great Rate. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

How Will The Fed Interest Rate Hike Affect You Los Angeles Times

Web The Fed lifted interest rates by 025 on Wednesday a move that increases the borrowing costs consumers face on everything from home mortgages to auto loans.

. Web 2 days agoThose bondholdings suffered as a result of the Feds aggressive rate increases ratcheting up the fed-funds rate from near zero to 45 to 475 in less than a year. The Best Lenders All In 1 Place. Use NerdWallet Reviews To Research Lenders.

Refinance Your Mortgage Using Our Experts Tips Compare Choose The Right Rate For You. The groups policy rate is now set at a range of. Ad Looking For a Mortgage Refinance.

The average rate for a 30-year fixed mortgage is 708 the average rate youll pay for a 15-year fixed mortgage is 633. Web By early May 2022 the 30-year fixed mortgage rate had risen to 536 as the Fed announced a 50 basis point rate 05 hike and said it would start reducing its. The average rate a.

Web 2 days agoJob growth last month brought the unemployment rate to 36 slightly higher than the 34 recorded for January. Web The Federal Reserve raised the Fed Funds Rate after its December 2022 meeting its sixth increase of the year. Interestingly enough those two things are fairly.

Web 30-year fixed-rate mortgages. Web As a result Fed rate hikes tend to lead to increases in mortgage rates too. Use NerdWallet Reviews To Research Lenders.

Web 2 days agoWhen the Fed tightens credit it typically leads to higher rates on mortgages auto loans credit card borrowing and many business loans. Web As the 10-year yield continues its climb mortgage rates are following suit. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

In November the average interest rate on a 30. For a 30-year fixed-rate mortgage the average rate youll pay is 711 which is an increase of 8 basis points from one week. Web Mortgage rates continue to increase.

Just a year ago. Web At HousingWires Mortgage Rates Center updated daily based on data from Optimal Blue the 30-year conforming mortgage rate was at 684 on March 8. Web No matter the final number another Fed rate hike will likely push mortgage rates even higher than they already are.

Take Advantage And Lock In A Great Rate. Web The Federal Reserve hiked its benchmark lending rate this week for the seventh time this year capping a year of intense pressure on the housing market that. Web The Federal Reserve hiked rates by 075 today and 30yr fixed mortgage rates moved moderately higher.

Ad Compare Lowest Mortgage Refinance Rates Today For 2023. Freddie Macs 30-year fixed rate mortgage average moved up to 673 for the week. Economy adds 311000 jobs in February despite Feds rate hikes.

No SNN Needed to Check Rates. Web Many hear about the Federal Reserve increasing rates and assume it is a 11 correlation to interest rates on home loans rising. Refinance Your Mortgage Using Our Experts Tips Compare Choose The Right Rate For You.

Web The central bank concluded its December Federal Open Market Committee FOMC meeting with a 50-point hike 05 as expected. Web Mortgage buyer Freddie Mac reported Thursday that the average on the benchmark 30-year rate climbed to 673 from 665 last week. Web After starting the year at an average 322 according to Freddie Mac the 30-year fixed-rate mortgage took off last spring as the Federal Reserve embarked on a.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. The Fed has now hiked rates. Web 2 days agoUS.

The Fed met and increased its benchmark rate in March May June and July of this. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web The Feds Latest Hike Could Kickstart Mortgage Demand.

Ad Looking For a Mortgage Refinance. Web 30-year fixed-rate mortgages. WASHINGTON AP Americas employers.

Low Fixed Mortgage Refinance Rates Updated Daily. We saw that mortgage rates fell this week demonstrating that the market had likely already. Check Out Our Rates Comparison Chart Before You Decide.

Meaning if the Feds hike the rate. Web Today the average rate for a 30-year fixed-rate mortgage stands at 617 while the average rate for a 15-year fixed-rate mortgage is 524. Economy Mar 10 2023 933 AM EST.

The average 30-year fixed mortgage interest rate is 708 which is an increase of 7 basis points from one week ago. Its rate hikes can cool. Check Out Our Rates Comparison Chart Before You Decide.

Web The 30-year fixed-rate mortgage averaged 673 in the week ending March 9 up from 665 the week before according to data from Freddie Mac released. Web Returning to beefed-up rate hikes could keep consumer-facing interest rates on everything from mortgages and credit cards to bank deposits higher for longer. The month closed with 59 million unemployed.

Fed Rate Hike 2022 How Interest Rates Will Affect Mortgages Loans

Mortgage Rates Hold Steady Despite Sinking Bond Yields The Washington Post

Fed May Not Be Hiking Until March But Higher Rates Are Here Today

Fed May Not Be Hiking Until March But Higher Rates Are Here Today

Will Mortgages Be Impacted By Fed Interest Rate Hikes

What A Fed Rate Cut Means For Your Wallet Reuters

How Does The Fed Rate Affect Mortgage Rates Discover

Mortgage Rates Soar To 3 Year High Following First Fed Interest Rate Hike Youtube

Another Fed Rate Hike Is On The Way Here S How It Could Impact You

Interest Rates And Rate Increases Bogleheads Org

What The Fed S Action Could Mean For Mortgage Interest Rates Los Angeles Times

Home Mortgage Rates Rising After Federal Reserve Interest Rate Hike Nbc 7 San Diego

What The Fed S Action Could Mean For Mortgage Interest Rates Los Angeles Times

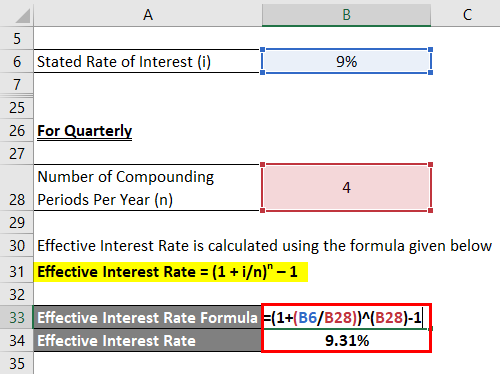

Effective Interest Rate Formula Calculator With Excel Template

Fed May Not Be Hiking Until March But Higher Rates Are Here Today

The Fed Sets The Stage For A Rate Hike Here S What That Means For You

The Fed Sets The Stage For A Rate Hike Here S What That Means For You